Online forex trading platforms are abundant, and many promise competitive conditions, advanced tools, and fast execution. CapPlace is one such platform that has attracted attention over the past few years. But before you deposit funds or start trading with any broker, it’s vital to understand whether it is legitimate and safe, or if there are serious risks you should be aware of.

This Capplace Review 2026 examines what CapPlace offers, how it is regulated, what users say, and whether it should be considered a reliable broker or treated with caution.

Quick Verdict

CapPlace is an online trading platform offering forex and CFD trading across multiple asset classes. CapPlace provides a range of account options such as Silver, Gold, and Platinum tailored to different trader experience levels, and gives users access to multiple markets for diversified trading opportunities.

What Is CapPlace?

CapPlace is a global CFD broker providing access to a wide range of financial instruments, including forex, commodities, and cryptocurrencies, as well as indices and stocks, through both web and mobile platforms. According to the CapPlace official website, its offering includes:

- Advanced proprietary WebTrader platform

- Real-time data feeds

- User-friendly mobile and web trading solutions

- Multiple account types tailored to different trader experience levels

- Tools like real-time analytics and earnings calendars

The broker emphasizes flexibility, user-friendliness, and aims to serve both beginners and experienced traders.

Company Background

CapPlace is a relatively new entrant in the online trading industry, established in 2023 by Robertson Finance Inc. Despite its recent founding, the company has quickly positioned itself as a comprehensive trading platform for a global clientele. Headquartered in the Union of Comoros, CapPlace operates under the regulatory oversight of the Mwali International Services Authority (MISA), which provides a framework for compliance and operational standards. The company’s mission centers on delivering a secure, user-friendly platform that accommodates the needs of both novice and experienced traders. By focusing on intuitive design and robust features, CapPlace aims to empower its clients to navigate the dynamic world of trading with confidence. The backing of Robertson Finance Inc. further underscores the company’s commitment to establishing itself as a reputable player in the industry.

Regulation and Safety

Registered and Licensed

CapPlace is operated by Robertson Finance Inc., which is registered in the Union of the Comoros under IBC number HY00523519. The company holds a brokerage license from the Mwali International Services Authority (MISA), license number T2023294.

MISA is an offshore regulator that issues brokers licenses for companies operating internationally. While this gives CapPlace a formal regulatory footing, it is important to note:

- MISA is not considered a top-tier financial regulator like the FCA (UK) or ASIC (Australia).

- Regulations from offshore authorities can offer basic oversight but generally lack investor compensation schemes and stringent compliance standards seen in tier-1 jurisdictions.

Client Fund Protection

CapPlace claims to use secure infrastructure and compliance with AML (Anti-money laundering) and KYC (Know Your Customer) procedures. However, information about segregated client funds (which protects trader deposits if a broker becomes insolvent) is not clearly detailed in publicly available official disclosures.

That means while some basic security measures are in place, traders should explicitly confirm:

- Whether funds are kept in segregated bank accounts

- Whether there is any negative balance protection

- How refunds and chargebacks are handled

This lack of clarity places CapPlace in a medium-to-high regulatory risk category compared with brokers under strong oversight.

Markets and Trading Conditions

CapPlace offers over 300+ CFD products as trading instruments across multiple markets, including forex, commodities, cryptocurrencies, indices, and stocks. This allows traders to access a wide range of financial instruments, allowing traders to diversify their portfolios and build exposure across different asset classes. The platform supports trading in major, minor, and exotic currency pairs, global company stocks such as Tesla, Apple, and Amazon, as well as index trading to monitor market segments.

Leverage on CapPlace is available up to 1:200 across all account types, with a minimum position size of 0.01 standard lots. Higher leverage enables traders to open larger positions with less capital, but it also increases risks, making solid risk management essential. While higher leverage can amplify profits, it also means potential losses are magnified, so understanding and applying risk management strategies is crucial when trading on CapPlace.

Many CFD brokers offer variable spreads and commission-free accounts, and CapPlace follows this industry pattern. However, spread and fee transparency is not always easy to verify without direct access to the trading platform or a live account.

Account Types and Features

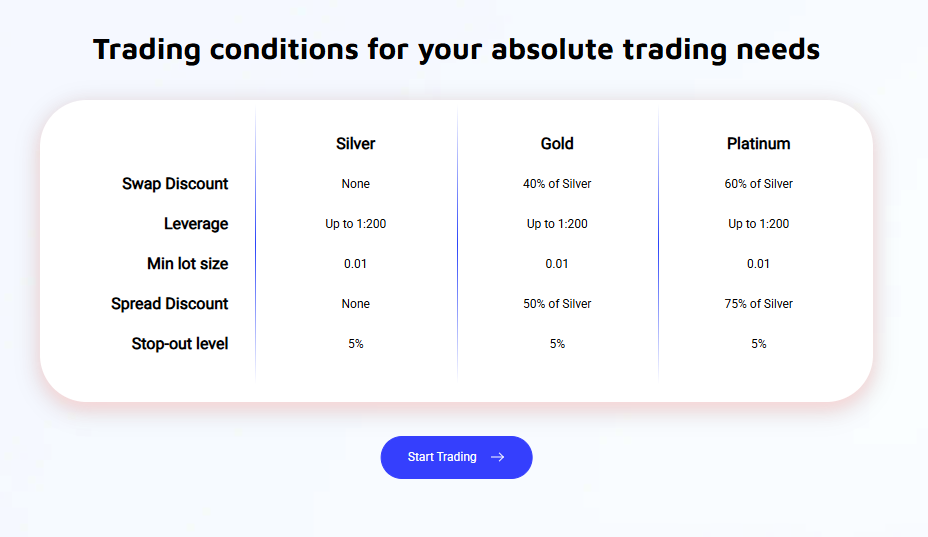

CapPlace offers three main account types Silver, Gold, and Platinum referred to as account options or account tiers, each designed for different trader experience levels. These account types at CapPlace are structured to cater to beginners, intermediate traders, and experienced professionals, providing flexibility and tailored features for each group.

- Silver Account: Designed for beginners, this account type includes essential trading tools such as charts and indicators, spreads starting at 0.01 pips (with entry-level spreads at approximately 1.4 pips), leverage up to 1:200, and a minimum position size of 0.01 standard lots.

- Gold Account: Tailored for intermediate traders, the Gold Account offers a 50% spread discount compared to the Silver Account, a minimum lot size of 0.01, enhanced trading tools, and lower trading costs through reduced spreads.

- Platinum Account: Aimed at experienced traders, the Platinum Account provides a 75% spread discount, a 60% swap discount, access to advanced market data and indicators, and the lowest trading costs among the account tiers.

All account types at CapPlace offer leverage of up to 1:200, a minimum position size of 0.01 standard lots, and transparent margin requirements to help manage trading risks. CapPlace also provides a demo account for beginners to practice trading strategies before committing real funds.

CapPlace’s fee structure features competitive spreads, with the Silver Account starting at approximately 1.4 pips, while Gold and Platinum accounts offer lower spreads through their discount structures. The minimum deposit required to open any account is $250, and all account types have a standard StopOut level of 5%.

While available information suggests flexibility in account choice, traders should always verify the exact minimum deposit, pricing tiers, and trading conditions before opening an account.

Platforms and Tools

CapPlace’s stated platform offerings include:

- WebTrader: Browser-based trading with charting and analytical tools

- Mobile App: For trading on the go with real-time execution Both platforms aim to be user-friendly and suitable for both new and experienced traders.

CapPlace’s proprietary WebTrader is designed for manual trading, emphasizing user control, traditional trading strategies, and simplicity. The platform does not offer a multi chart mode, focusing instead on a user-friendly interface for single-instrument analysis. Real-time data and analytics are available to assist traders in making timely and informed decisions.

Technical tools such as real-time analytics, earnings calendars, and advanced charting are promoted as part of the broker’s platform capabilities.

Fees, Spreads, and Costs

CapPlace generally advertises competitive markets and flexible trading conditions. CapPlace’s trading costs are influenced by account type, with competitive spreads starting from 0.01 pips on major currency pairs. The platform offers three main account types: Silver, Gold, and Platinum, each with different trading costs and benefits. The Silver Account starts at approximately 1.4 pips, while Gold and Platinum accounts offer lower spreads through discount structures. CapPlace claims to have no deposit, withdrawal, or inactivity fees. However:

- Official spread and fee schedules are not always published clearly on third-party review sites.

- User reviews vary, with some reporting satisfactory spreads and execution, while others highlight higher cost concerns.

Always check the broker’s contract specifications and official pricing documentation for accurate fees, swap charges, and payable costs before trading live.

Customer Support and Service

CapPlace recognizes that responsive customer support is essential for a positive trading experience. The broker offers multiple channels for clients to reach its support team, including live chat, email, and phone, ensuring that assistance is always accessible. The support team is composed of knowledgeable professionals who are dedicated to resolving queries efficiently, whether clients need help navigating the trading platform, managing their account, or seeking up-to-date market information. This commitment to high-quality customer support helps traders feel supported at every stage of their journey, from opening an account to executing trades. CapPlace’s focus on service is a key part of its strategy to build trust and foster long-term relationships with its clients, making the trading experience smoother and more reliable.

Deposits and Withdrawals Process

CapPlace strives to make funding and withdrawing from trading accounts straightforward and secure. The broker supports a range of payment methods, including credit and debit cards as well as wire transfers, to accommodate the preferences of its diverse client base. With a minimum deposit set at $250, CapPlace offers an accessible entry point for those looking to start trading. Importantly, the broker does not impose commissions on deposits, allowing clients to allocate more money directly to their trading activities. Withdrawals are typically processed within 72 hours, depending on the chosen payment method, reflecting the broker’s commitment to efficiency. To ensure the safety of client funds and maintain regulatory compliance, CapPlace requires identity verification as part of its standard procedures. This not only protects against fraud but also aligns with industry best practices for safeguarding client assets.

User Reviews and Community Feedback

Online user reviews for CapPlace are mixed:

Positive Feedback

Some traders report:

- Stable execution and smooth web/mobile platform performance

- Quick withdrawals and responsive customer support

These reviews tend to focus on basic trading experience rather than in-depth technical evaluation.

Negative Feedback

Other reviews and community posts raise significant concerns:

- Reports of withdrawal issues or difficulty accessing funds

- Account service practices may not align with expectations

Pros and Cons Summary

Pros

- Wide range of CFD and forex markets

- Multiple account types for different trading styles

- Web and mobile platforms with analytical tools

- Official licensing under an offshore regulator (MISA)

- Reviews noting ease of use and responsive support from some users

Cons

- Offshore regulation may not offer strong investor protection

- Mixed user reviews, including some serious complaints

- Regulatory alerts in some jurisdictions advising caution

- Limited transparency around spreads and fees on third-party sites

Is CapPlace Legit or a Scam?

CapPlace cannot be definitively labeled a scam in the absence of verified evidence of fraud. It is a licensed broker under the Mwali International Services Authority (MISA) and provides standard trading services across forex and CFDs.

However, several factors temper confidence:

- Its offshore regulation is not as stringent as top-tier regulators.

- User feedback is mixed, with some reporting problems with withdrawals or account guidance.

For traders, this means the platform is best approached with caution. If considering CapPlace, start small, verify key policies, and do your own due diligence, including checking local regulatory status and withdrawal procedures.

How To Test CapPlace Safely (Before Trading Live)

- Open a demo account to assess spreads and execution.

- Check regulation details with the official MISA database.

- Verify fund protection and segregated account policies.

- Make a small test deposit and attempt a withdrawal.

- Contact customer support with fee and verification questions.

- Compare with regulated alternatives before committing larger funds.

Forex Trading Education and Resources

Understanding that informed traders are more likely to succeed, CapPlace invests in a comprehensive suite of educational resources and trading tools. The broker provides a variety of materials, from beginner guides to advanced trading strategies, catering to traders at all experience levels. Clients have access to real-time market data, advanced charts, and powerful analytical tools, all designed to support the development and refinement of effective trading strategies. For those new to trading or looking to test new approaches, CapPlace offers a demo account, allowing users to practice in a risk-free environment before committing real funds. This focus on education and skill-building demonstrates CapPlace’s commitment to helping its clients make informed decisions and manage potential risks, ultimately contributing to a more confident and capable trading community.

FAQ

- Is CapPlace regulated?

CapPlace is licensed by the Mwali International Services Authority (MISA), an offshore regulator. This provides some level of oversight but not the same investor protections as top-tier regulators. - Can CapPlace be considered a scam?

There is no conclusive evidence proving CapPlace is a scam, but users should exercise caution due to mixed reviews and limited regulatory strength. - Can I trade forex and CFDs on CapPlace?

Yes, CapPlace offers forex, commodity, indices, stock, and crypto CFD trading. - How do I verify CapPlace’s license?

Visit the official regulator’s website (MISA) and search for the broker’s license number (T2023294). - Are withdrawals reliable?

Withdrawal experiences vary by user. Some traders report smooth withdrawals, while others note delays. Always test with a small amount first.