Choosing a forex broker in 2026 is not only about finding low spreads. Traders also want fast execution, reliable platforms, and clear trading conditions. FirstECN is a registered financial services provider regulated under the MWALI International Services Authority (MISA), which offers operational credibility, and presents itself as an ECN-focused trading provider, offering access to multiple financial markets and modern trading tools.

In this FirstECN Review 2026, we explain the broker’s trading conditions in simple terms. We cover platforms, spreads, execution model, account structure, fees, and safety factors that matter most to real traders. The goal is to help you understand what FirstECN offers and whether it matches your trading style.

Quick Verdict

FirstECN offers a trading environment designed for forex and CFD traders who value ECN-style execution, competitive spreads, and access to popular trading platforms. FirstECN operates with an offshore regulatory status, which may impact risk and investor protection, making it more suitable for retail traders seeking simplicity rather than institutional or professional traders needing a more regulated environment.

The broker appears suitable for both beginners and active traders, especially those who prefer flexible trading conditions. However, traders should be aware that FirstECN is considered high-risk due to its offshore regulation and high leverage. FirstECN provides 24/5 customer support through multiple channels, emphasizing direct communication and quick issue resolution during market hours. Traders should still review the broker’s legal documentation and confirm regulatory details before depositing larger funds.

What Is FirstECN?

FirstECN is an online forex and CFD broker that provides access to global markets through a web-based trading environment and professional trading platforms. As the name suggests, FirstECN focuses on ECN trading conditions, meaning it aims to provide pricing based on liquidity and market demand rather than fixed dealing desk spreads.

FirstECN operates under Nakito SA, a registered financial services provider regulated by the MWALI International Services Authority (MISA) in the Comoros Union. The company’s official address is Bonovo Road, Fomboni, Comoros. As a regulated broker, FirstECN operates within a licensing framework that ensures compliance with legal and financial standards, including client-fund segregation, AML/KYC procedures, and risk management. While MISA is considered a mid-tier regulatory jurisdiction, this licensing arrangement provides operational legitimacy and regulatory oversight for FirstECN.

This approach can be useful for traders who want more transparent execution and market-based spreads. It is also attractive for scalpers and intraday traders who depend on fast order processing.

Markets and Instruments Available

According to the broker’s positioning, FirstECN offers trading access across multiple asset classes. These typically include:

- Forex pairs (major and minor currencies)

- Commodities (such as metals and energy products)

- Indices CFDs

- Shares or stock CFDs (depending on availability)

- Other CFD instruments

FirstECN provides access to over 300 tradable instruments across five key asset classes: Forex, Stocks, Commodities, Indices, and Cryptocurrencies. As a CFD platform, FirstECN allows traders to speculate on price movements of these major global asset classes without owning the underlying assets.

This variety allows traders to build strategies beyond forex and diversify their positions across different markets.

For most users, forex remains the main attraction, but having indices and commodities can be useful for hedging or portfolio expansion.

Trading Platforms and Tools

A broker’s platform matters because it impacts execution speed, charting, and the overall trading experience.

The FirstECN trading platform offers a streamlined trading environment with a clean browser-based trading terminal (WebTrader), modern charting tools, and advanced tools for different trading styles. The platform provides essential trading tools, including real-time market data and real-time data visualization, supporting both casual and high-frequency traders. FirstECN combines a clean WebTrader interface, real-time market data, and three structured account tiers to support different trading styles. Its trading infrastructure is designed for cross-device compatibility, delivering a seamless trading experience for both new and moderately experienced traders.

MetaTrader Compatibility

FirstECN promotes access to industry-standard platforms, including:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

These platforms are widely used across the forex industry because they provide:

- advanced charting tools

- built-in indicators

- custom indicators and scripts

- Expert Advisors (EAs) for automated trading

- multi-device access (desktop, mobile, and web options)

MT4 is often preferred by traditional forex traders, while MT5 offers additional features and more instrument support.

Web and Mobile Trading

For modern traders, mobile trading is essential. FirstECN offers a dedicated mobile app (FirstECN Mobile App) and a mobile platform optimized for active trading, enabling users to monitor markets and execute trades conveniently from their mobile devices. The mobile app provides access to CFD markets and incorporates modern charting tools and intuitive navigation, ensuring a seamless cross-device trading experience for traders of all levels. FirstECN supports trading access through browser-based systems and mobile-friendly interfaces, allowing traders to monitor markets and manage positions on the go.

Account Types and Trading Conditions

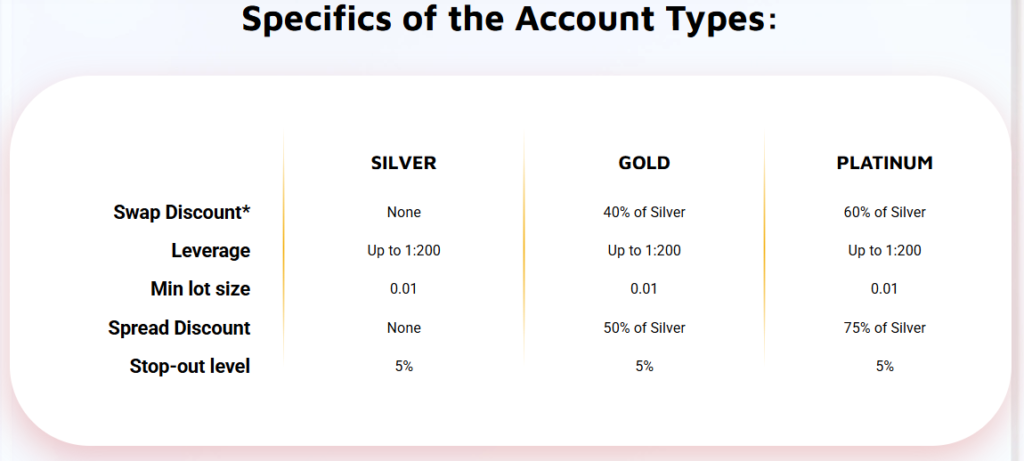

FirstECN offers three structured account tiers designed to accommodate varying levels of trading experience and trading goals. The account types FirstECN offers primarily differ in pricing benefits, swap/spread conditions, and cost-efficient trading options, allowing traders to select the trading account that best matches their needs. Basic trading accounts offer minimal or even zero commissions, while platinum accounts may charge commissions but provide more cost-efficient trading through better pricing benefits and favorable swap/spread conditions. These structured account tiers are designed for retail traders seeking simplicity, making FirstECN suitable for those who prefer straightforward trading without complex features.

While exact account structures can vary, most ECN-focused brokers provide tiered accounts that differ based on:

- spreads

- commissions

- minimum deposit requirements

- leverage limits

- access to additional features

Who These Accounts Suit

- Beginners may prefer accounts with simpler spread-based pricing

- Active traders may prefer ECN accounts with raw spreads and commission-based pricing

- Professional traders may benefit from accounts designed for high-volume trading and tighter spreads

This account flexibility is a positive feature because it allows traders to choose pricing models that match their style.

Spreads, Fees, and Trading Costs

Trading fees are where most traders either gain or lose money over time. Even small spread differences matter when trading frequently. Spreads at FirstECN start from as low as 0.1 pips on major pairs and typically average between 1.2 to 1.9 pips, which is competitive for active traders.

FirstECN does not charge any internal deposit fees, but external deposit fees may apply depending on your payment method. There is limited detailed public information regarding fee breakdowns outside of the account tiers, so traders should review all available documentation before funding their accounts.

The maximum leverage offered by FirstECN is 1:200 on major pairs, which is considered moderate compared to some offshore brokers. This maximum leverage allows traders to control larger positions with smaller capital, amplifying both potential profits and risks.

FirstECN facilitates directional trading based on price movements, enabling traders to go long or short on various assets without owning the underlying assets. This flexibility supports a range of strategic trading approaches, allowing users to capitalize on both rising and falling markets.

Spreads

FirstECN positions itself as a broker offering competitive spreads. With ECN-style execution, spreads are usually variable, meaning they change depending on liquidity.

Spreads tend to be tight during high-liquidity sessions but may widen during:

- major economic announcements

- low-volume trading hours

- extreme volatility events

This is normal across most ECN brokers.

Commission Structure

If you use an ECN account, you may pay a commission per trade in exchange for lower spreads. This model is often preferred by scalpers and day traders because it can reduce overall cost per trade.

A smart approach is to calculate the all-in cost:

Total cost = spread + commission + swap fees

Swap Fees

Swap fees (overnight financing charges) apply when you hold trades overnight. These fees vary depending on the asset and market interest rates.

Traders who hold positions long-term should always review swap rates because they can significantly affect profit.

Execution Speed and ECN Model

FirstECN markets itself as an ECN-style broker, which generally implies faster execution and pricing based on real market liquidity.

In ECN conditions, execution quality depends on:

- liquidity provider access

- server stability

- order routing systems

- market volatility

For active traders, this model can provide better price transparency compared to brokers that run dealing desks.

However, traders should still expect occasional slippage during high-impact news events, as this happens across all brokers.

Risk Management Strategies

Effective risk management is at the heart of successful online trading, and FirstECN has built its modern CFD trading platform with this principle in mind. Recognizing the diverse needs of both retail traders seeking simplicity and advanced professional traders, FirstECN offers a comprehensive suite of risk management tools and features designed to help users navigate market volatility with confidence.

The FirstECN trading platform equips traders with essential modern trading tools, including standard risk management options like stop-loss and limit orders. These features allow users to set predefined exit points, helping to minimize potential losses and lock in profits even when they are away from their screens. For those who want to stay ahead of fast-moving markets, the platform also provides price alerts and instant notifications, ensuring that traders are promptly informed of significant price movements or when their risk parameters are triggered.

A key advantage of FirstECN is its access to real-time market data, available through both its browser-based trading terminal and intuitive mobile app. This infrastructure enables traders to monitor key asset classes and execute trades based on the latest information, which is crucial for managing risk in dynamic financial markets. Whether you prefer to trade from your desktop or on the go, FirstECN’s mobile trading capabilities ensure you never miss an opportunity to adjust your positions in response to changing market conditions.

FirstECN’s account structure is designed to support different trading styles and risk appetites. The broker offers three structured account tiers, including the popular Silver Account, each with its own pricing benefits and features. These tiers primarily differ in terms of spreads, commissions, and access to advanced tools, allowing traders to select the account that best aligns with their trading goals and desired level of cost efficiency.

Regulatory oversight is another cornerstone of FirstECN’s approach to risk management. The broker operates under the MWALI International Services Authority, providing traders with the assurance that operational and financial guidelines are in place to protect their interests. This mid-tier regulatory framework helps ensure that FirstECN maintains transparent practices and adheres to industry standards for client fund safety.

To further simplify online trading and risk management, FirstECN offers a streamlined trading environment. The platform’s modern UI, combined with instant notifications and real-time data, makes it easy for traders to monitor their exposure and react quickly to market developments. For those who need assistance, the customer support team is readily available via the website contact form, offering guidance on risk management strategies and platform features.

FirstECN also supports a variety of deposit and withdrawal methods, including bank transfers and instant payment systems. While deposit fees and broker processing times typically depend on the chosen method, the platform’s commitment to operational efficiency ensures that traders can manage their funds with minimal disruption to their trading activities.

In summary, FirstECN’s risk management strategies are thoughtfully integrated into every aspect of its trading infrastructure. By combining essential trading tools, real-time market data, structured account tiers, and robust regulatory oversight, FirstECN offers a secure and reliable trading experience for traders of all levels. Whether you are just starting out or are an advanced professional seeking deep institutional features, FirstECN’s modern CFD trading platform is designed to help you manage risk effectively and trade with confidence.

Risk Management Strategies

Effective risk management is at the heart of successful online trading, and FirstECN has built its modern CFD trading platform with this principle in mind. Whether you’re a retail trader seeking simplicity or an advanced professional looking for deep institutional features, FirstECN offers a suite of essential modern trading tools designed to help you navigate market volatility and protect your capital.

Deposits and Withdrawals

Deposit and withdrawal reliability is one of the most important parts of any broker experience.

FirstECN offers more than 11 payment methods for deposits and withdrawals, including instant payment systems, credit/debit cards, and popular e-wallets. Deposits typically reflect instantly or within a few minutes, depending on the method used, while withdrawals can take up to three business days to process depending on the payment method and the bank. FirstECN does not charge internal fees for withdrawals, but external card-issuer or processor fees may apply.

FirstECN provides funding options designed for international traders, which may include:

- bank transfers

- card payments

- e-wallet solutions

- alternative payment options depending on region

Processing times and fees depend on the method used. Traders should always review withdrawal policies carefully, including:

- minimum withdrawal amounts

- verification requirements

- processing timelines

- potential third-party payment fees

Testing with a small deposit first is always a smart approach.

Safety, Transparency, and Broker Trust

FirstECN presents itself as a professional broker, but like with any broker, traders should verify the following before depositing significant funds:

- legal entity details

- client agreement terms

- risk disclosures

- AML and KYC requirements

- fund handling policy

FirstECN is a regulated CFD platform operating under the Mauritius International Financial Services Authority (MISA), which provides recognized regulatory oversight, though it is considered a mid-tier jurisdiction. As a regulated broker under MISA, FirstECN must comply with operational and financial guidelines, including client-fund segregation and adherence to AML/KYC procedures. These measures are designed to enhance transparency, manage risks, and ensure the safety of client funds.

A strong broker should clearly explain whether it offers:

- segregated client funds

- negative balance protection

- dispute resolution procedures

In this firstecn review 2026, the broker is evaluated using industry standard evaluation criteria, focusing on transparency, regulation, and trading infrastructure to provide an objective assessment for traders.

The safest approach is to rely on official documents, not marketing statements alone.

Customer Support and Trading Assistance

Customer support is often overlooked until something goes wrong. FirstECN provides support channels that are useful for traders needing help with:

- account verification

- deposit and withdrawal questions

- trading platform login issues

- fee clarification

Before opening a live account, it is a good idea to contact support with a simple question and evaluate response time and clarity.

Pros and Cons

Pros

- ECN-style pricing structure suits active traders

- Access to MT4 and MT5 platforms

- Multi-market trading options including forex and CFDs

- Competitive spreads during normal liquidity

- Suitable for both beginner and intermediate traders

Cons

- Spreads may widen during volatility (common in ECN brokers)

- Swap and commission fees must be checked carefully for long-term trading

Final Verdict: Is FirstECN Worth Considering in 2026?

This FirstECN Review 2026 shows that the broker offers a trading environment designed for modern forex traders. Its ECN-style structure, competitive spread model, and platform compatibility make it a reasonable option for traders who want flexibility and professional tools.

For best results, traders should review all fees, test the platform with a small deposit, and verify the broker’s official documentation before committing serious capital.

FAQs

Is FirstECN a good broker for forex trading?

FirstECN can be a suitable broker for forex traders who want ECN-style pricing, access to popular platforms like MT4 and MT5, and competitive trading conditions. However, traders should review fees and legal documents before depositing.

Is FirstECN regulated and safe to use?

FirstECN provides broker services internationally, but traders should always verify regulation details directly through official documents and regulator databases to confirm safety and investor protections.

What trading platforms does FirstECN support?

FirstECN supports major trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely used for forex and CFD trading.

Does FirstECN offer ECN accounts?

Yes, FirstECN promotes ECN-style trading conditions. ECN accounts generally offer lower spreads, but they may include commissions depending on the account type.

Are FirstECN spreads low in 2026?

FirstECN spreads are designed to be competitive, especially on major forex pairs. Since spreads are typically variable, they may widen during high volatility or major economic news.