Vested Finance is one of only a few brokerages offering a platform for Indian investors to invest in Global Stocks conveniently. Being a new market player, many people are unaware of this platform, what it is and what services it offers. So, to help them out, here’s a detailed Vested Finance Review 2024.

The platform has managed to maintain a good position in the competitive environment for 4 years. The platform primarily focuses on Indian investors, letting them invest in stocks with zero commission.

It is worth noting that the platform allows investors to invest in different financial instruments, such as vests, Stocks/ETFs and Trends. Beyond that, it offers other exciting services such as learning resources and good customer support.

This research-backed & updated Vested Finance review 2024 will give deeper insights into the platform based on its fees, regulatory compliance, product offerings and brokerage account offerings.

Vested Finance Review 2024: Quick Overview

| Official Website | https://vested.co.in/ |

| Headquarters and its Address | California, USA222 N Sepulveda Blvd 10 124, El Segundo, CA 90245 |

| Physical Offices Location | USA, Mumbai, Maharashtra, Bangalore, Karnataka |

| Account Currency | USD |

| Establishment Year | 2018 |

| Instruments | Stocks/ETFs, Trends, Vests |

| Additional Services | Customer Support, Learning Sources |

| Minimum Balance | N/A |

| Minimum Investment | $1 |

| Supported Countries | 50+ |

| Withdraw Time | Instant |

What Is Vested Finance?

It is a brand new-age making investment platform allowing humans to invest in US Stocks and ETFs from India through its partner – VF Securities, Inc. (Member FINRA /SIPC). The platform became advanced with the aim of encouraging Indian traders to take blessings of the US equity market.

The investing platform operates below Vested Finance Inc., an investment adviser registered with the Securities and Exchange Commission (SEC), with headquarters at Berkeley, California, United States (USA).

Is Vested Finance Scam?

If you’re questioning the legitimacy of Vested Finance, fear not. The platform operates within the bounds of the law and is not a scam. Instead of directly investing in US stocks, they use Drivewealth, a reputable US-based brokerage partner, which is regulated by both The Financial Industry Regulatory Authority and The Securities Investor Protection Corporation, both overseen by The Securities and Exchange Commission.

In addition, Vested Finance itself is registered with the SEC, solidifying its legal standing. As a US-based company catering to Indian investors seeking US stock opportunities, they operate transparently under the jurisdiction of the appropriate authorities.

Unique Features Of Vested Finance

The key features of the Vested platform that make it stand out from other platforms are mentioned below:-

- No need to maintain a minimum balance

- Quick Account Opening Process

- No restrictions on minimum withdrawal

- Fractional share investing

- Start investing in US stock with zero commissions

Vested Finance Products & Financial Instruments

The platform currently allows clients to invest in three major instruments through its partner -VF Securities, Inc. (Member FINRA /SIPC). The available investment instruments include

Vests

Vests refer to the curated portfolios comprised of Shares and ETFs. These theme-based investments include features like

- Zero Commission Investing – Make an investment in US instruments with zero brokerage fees.

- Fractional Share Investing – Investors can spend money on stocks as low as 1 US Dollar

- Partnership with top brokerage firms – The platform is partnered with top brokerage companies which include 5Paisa, Axis Securities, and many others.

Stocks/ETFs

Vested has more than 1000 US shares/ETFs, allowing Indian residents to invest with benefits like:

- Curated diversified portfolios to cover the risk

- Properly optimized with research allocation

- Dynamic rebalancing

Trends

The investing platform allows you to invest in trends of global companies, including

- TSLA

- AMZN

- AAPL

- MSFT

- GOOGL

Vested Finance Fees & Pricing Overview

The platform offers a basic & premium plan to their clients. You can choose a plan which suits you the best and your needs. Additionally, there are deposit and withdrawal fees apply.

Let’s quickly look at Vested pricing plans, along with their withdrawal and deposit fees, in the table mentioned below:-

| Basic | Premium | |

| Investing Amount | ₹0 | ₹4500/year |

| Transaction Fee | 0% | 0% |

| Accessible to all eligible shares & ETFs | Yes | Yes |

| Fund Transfers | ||

| Deposit fee | std. bank charges | std. bank charges |

| Withdrawal fee | $5 /withdrawal | $5 /withdrawal |

| Free withdrawals | 0 | 2 per year |

| VESTS: Pre-built portfolios by Vested | ||

| Vest portfolio purchase fee | 0.5% of investment amount (max: $3) | Free |

| No. of Vests Accessible | 7 | 10 |

| Alphascreener: Track, Screen, Backtest | ||

| AlphaScreener Plus | Not Available | Included |

| OTC SECURITIES | ||

| Invest in OTC Securities | Not Available | Included |

| Premium Support | ||

| Access to Premium Support | Not Available | Included |

Vested Finance Review 2024: Pros & Cons

| Pros | Cons |

| The platform offers unique features such as trend analysis and thematic portfolios. | Trading instruments such as cryptocurrencies, commodities, and bonds are not available |

| Indians can invest in US stocks with zero commission. | No availability of platforms such as MetaTrader4 and MetaTrader5 |

| Minimum Withdrawal and Deposit fees | |

| It has a transparent commission structure, | |

| Easy to create an account within a few minutes | |

| SEC Registered and followed the guidelines of RBI LRS | |

| Traders can sell and withdraw funds anytime. | |

| Facility to buy stocks in fractions |

Vested Finance Registration Process

The account creation process is completely paperless and can be completed in just a few minutes. Here is the summarised guide to creating a brokerage account on the Vested platform.

- Visit the official website i.e. https://vested.co.in/.

- Click on the “Start Investing” icon.

- On the next page, choose one of your existing Email, Google, Facebook, or Apple accounts to sign up.

- Once you have completed the process, you will be given two options – Explore the Platform and Complete KYC. To create an account and start investing, you should complete the KYC first. So click on the Complete KYC button and confirm the details.

- Fill in all the details and provide identity proof and address proof. You can even have to offer your PAN range and a scanned replica of your PAN card.

- After that, you must upload your photo in the prescribed format.

- After completing all the KYC processes, you can access your Vested Account.

The complete procedure will only take a maximum of 5 minutes. Just make sure to keep your details and documents like PAN Card, utility bill, Aadhar card, bank, mobile phone bill or credit card statement ready.

Also Read: Delta Exchange Review 2024

Vested Finance Review 2024: Learning Resources

The platform offers a wide range of learning resources to investors who are willing to learn about the financial markets, investment options and exchange securities. Here’s a list of available learning materials, including:

- Blogs

- FAQs

- Trading Article

- News Updates

- Video Tutorials

- Podcast

Vested Finance Review 2024: Customer Support

The customer support system of Vested platform is appreciable, with a dedicated team ready to serve customers 24×5. The team responds to queries quickly and comes up with accurate answers.

Here’s how you can contact Vested customer support:

Drop an Email at: help@vestedfinance.co

You can contact Vested Toll-Free Number 91 95 1337 5607 from Mon to Fri between 10 am to 7 pm IST)

You can also drop a message by providing information such as name, email address, and phone no. and type a message about whatever you want to convey to the support team.

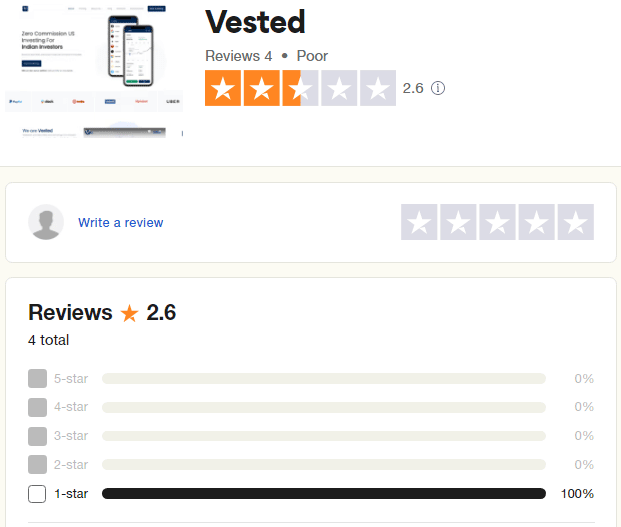

Vested Finance Reviews & User Ratings

The platform has an average reputation among its users, with a rating of 2.1/5 on Trustpilot. The low rating of its users indicates the platform may have a few flaws that should be improved.

Top Vested Finance Alternatives

INDmoney vs Vested

Vested Finance Vs INDmoney, are both personal finance apps that allow users to track their spending, set budgets and save money. It is worth mentioning that these two apps have some differences you need to consider before choosing one.

The Vested platform offers a wider range of features than INDmoney, including tracking investments and creating a personalized financial plan. INDmoney, on the other hand, is more focused on helping users save money and track their spending.

Another difference is that Vested Finance is a paid app, whereas INDmoney is free.

Vested Finance vs Upstox

| Vested Finance | Upstox | |

| Registered | SEC | SEBI |

| Based | US-Based | Indian Based |

| Established Year | 2018 | 2009 |

| Trading Instruments | Vests, Stock/ETFs, Trends through VF Securities | Equity, F&O, Currency and Commodities, Mutual Funds |

| Commission | Zero commissions | Zero commissions on mutual funds & IPO While the platform charge 20% per order on Equity, F&O, Commodity and Currency |

| Ratings | 3.1 out of 5 | 3.9 out of 5 |

| Platform Supported | Vested Mobile app, Web Platform | Desktop and Web |

Vested VS Stockal

| Vested Finance | Stockal | |

| Charges & Fees on Plans | Basic – 0 per year, Premium ₹4,500 | Global – 0 per year, Global Plus Plan 9,999 per year. |

| Established Year | 2018 | 2016 |

| Motto | Vested Finance allows Indians to invest in the US stock market | Stockal allows making investments and savings internationally. |

| Products | Stocks/ETFs, Vests and Trends | Stocks/ETFs, Stacks, Funds and Cash Management |

| USP | Quick brokerage account opening | Simple, Secure, Smart |

| Total Funding Amount | $ 16.4 Million | $ 14.8 M |

| Investors | 21 | 21 |

Final Thoughts On Vested Finance Review 2024

Through this in-depth analysis of Vested Finance Review 2024, we can conclude it to be a secure investment platform, protected with automated log-outs and a two-factor authentication process.

Vested Finance offers various learning resources, such as FAQs and blogs, which help traders exchange securities.

Still, the platform lacks at some points, including round-the-clock customer support and limited product offerings. However, you can move to a much better recommendation – InvestBy. The platform has over 250+ devices for getting and selling and investing in, with 24×7 customer service and the tightest spreads within the agency.

Frequently Asked Questions (FAQs)

Is Vested an Indian Company?

It is a US FinTech entity company that allows Indian investors to invest in US stocks or ETFs quickly and without any hassle. Also, Indian citizens can open an account on Vested Finance within a few minutes. So, no, Vested is not an Indian company.

What is the Minimum Investment for Vested?

The minimum investment for Vested is just 1 US Dollar. Also, you can create an account within a few minutes.

How do I Invest in Vested?

It’s quite easy to make an investment with Vested by opening an account on the platform. Investors can also invest at Vested with less than one share. Follow the three simple steps if you want to invest with Vested:-

- Create an account

- Fund your account, which means depositing some amount of money into your account

- Start Investing right away – just after opening the account

Who is the Founder of Vested Finance?

Vikram Shah is the founder of Vested finance company and is also the Co-founder and CEO of Vested Finance Inc.

Vested vs Zerodha: Which is Better?

While Zerodha is focused on offering service to Indians only, Vested accept both Indian and foreign investors. At the same time, Vested is comparatively a low-cost investment platform than Zerodha.

What are Vested Finance Charges?

The charges of Vested may vary from plan to plan and the bank account you are using. There is a fixed cost between INR 500 – 1500 per fund transfer.

Is Vested Legal in India?

Yes, Vested is legal in India. The fintech company follows the proper guidelines of RBI’s Liberalized Remittance Scheme (LRS) and is registered with the Securities Exchange Commission.

How to Invest with Vested?

It’s quite easy to make an investment with Vested by opening an account on the platform. Investors can also invest at Vested in a manner that is even possible with less than one share. Follow the three simple steps if you want to invest with Vested:-

- Create an account

- Fund your account, which means depositing some amount of money into your account

- Start Investing right away – just after opening the account

What if Vested Shut Down?

Client’s assets are kept secure with a 3rd party custodian and the Vested Finance platform doesn’t even have any connection with money as the platform doesn’t hold money. If in the worst case, Vested Finance shuts down, the clients can access their account, cash and securities via DriveWealth, a prominent platform for investing where traders can continue their journey of buying or selling securities.

On top of that, if DriveWeath and Vested Finance both will shut down, your securities are insured by SIPC (Securities Investor Protection Corporation), which offers up to $500,000 ($250,000 in cash) to vested users who have an account on Vested Finance.

Can Vested Be Trusted?

Vested is a trustworthy exchange platform because it is registered under US SEC and follows the proper rules and regulations of the US government. On top of that, it follows the LRS proper guidelines to serve its customers the best exchange services. So, Vested can be trusted.

How Do I Withdraw Money from A Vested Account?

The platform has a seamless investing process, from opening an account to withdrawing funds. Withdrawing funds from a Vested account is not as easy as it looks. You have to follow some steps for withdrawals:-

- You must have the Vested application on your smartphone

- Various options will be shown on your display screen – open an account, add funds, start investing, track your portfolio, get detailed taxed reports, or withdraw funds.

- Click on Withdraw Funds Option

- After clicking on Withdraw, a dashboard will be displayed on your screen, showing all the information, like how much money you have in your wallet.

- There are two options add funds and withdraw funds. Click on withdraw funds.

- Enter the amount and how much money you want to withdraw. It must be noted that drive Wealth will charge $11 as a withdrawal fee per transaction.

- Click on Next’’which is highlighted with a green tab button.

- Moving forward, the Withdrawal details page will open. After going through it once, click on the Continue button.

- Enter the verification code that will be sent to your Gmail account

- Your withdrawal request has been initiated

What is the Withdrawal Fee in Vested Finance?

If you want to withdraw funds from a Vested Account, then Drive Wealth will charge $11 per transaction as a withdrawal fee.

Is Vested SBM Safe?

Yes, vested has partnered with SBM (State Bank of Mauritius), allowing Indian residents to invest in US stock. Through SBM, the user can send money abroad at a low cost.

How Do You Deposit Vested?

If you want to load the USD on your Vested brokerage account, initially, you have to request a USD deposit through the Vested Finance app. SBM requires a bank statement for 12 months of your existing bank account in case you are depositing the USD amount for the first time.

Is Vested Account Free?

Vested offers two types of accounts: Basic and Premium. Basic is a free plan, while the premium plan charges 4,500 per year. Other fees like withdrawal and funds transfer may vary from plan to plan

Is Vested Balance Taxed?

Vested balance charge taxes based on taxation events, which is categorized into two types:-

- Taxes on investment Gains

- Taxes on Dividends

Taxes on investment Gains

The taxes will be levied in India under the investment Gains events but not in the US.

Taxes on Investment Gains will depend on how long you hold the investment. For example, you hold the investment for 24 months as it comes under the long-term capital gain, and the tax rate is 20% for this, along with the indexation benefit. The taxes will be charged for short-term capital gains (below 24 months) according to the income earned.

Taxes on dividends

The US will charge a flat rate of 25% on taxes on dividends. It relies on the Double Taxation Avoidance Agreement (DTAA) that will be applicable to dividends, which will benefit both US and India, when taxpayers have already paid 25% tax in the US as it allows them to offset the already paid tax.

Is Vested Registered With SEBI?

It is US based company, so it is registered with the Securities Exchange Commission (SEC) but not with the Securities Exchange Board of India.

What Is Vested Finance?

It is a US-based investing platform that allows Indian residents to invest in US stocks by opening an account online.

Is Vested Finance Tied Up with SBM Bank for Forex Transfers?

Vested Finance is a platform that allows Indians to invest in US stocks. Vested users are eligible to create an account with SBM Bank and transfer money to foreign countries at low costs. Therefore, yes, Vested has tied up with SBM State Bank of Mauritius in order to facilitate the forex transfers.

Is Vested Finance A Legitimate Investing Platform For US Markets?

The Fintech company takes action according to the RBI Liberalised Remittance Scheme guidelines. In this scheme, Indian citizens are entitled to send up to USD $250,000 annually to foreign countries. So, yes, Vested is also a legal investing platform for the US market.

It provides several benefits to Indian residents, such as going abroad to study, travel as well, and make investments in other countries.

What is the Potential Earning Power of Vested Finance?

The potential earning power of vested finance depends on factors such as which stock you are investing in and how much amount of money you are investing. You will get returns or interests based on the type of trading instruments, money, and what are the live market rates of that instrument at that certain point in time.

Is Vested Finance Safe? What are the Safeguards for Protecting the Stocks in My Account and the Money I Will Invest?

Yes, vested finance is completely safe. The finance company has used safeguards such as a two-factor authentication process or automatic logouts to protect the clients’ stocks.

Is Vested Finance Trusted Platform to Invest from India in Nasdaq?

Yes, Vested is the best stock app if you are considering investing in NASDAQ from India. The platform is specialised in trading instruments such as ETFs/Stocks and Vests.